Air travel is starting to suck soooo bad. Good thing these commercial are funny. I am going to post another one with vids that didn't qualify because too heartwarming, or not funny enough, or not a commercial.

Ranked by my preference. I'm the judge and jury.

10 Virgin America

9 AirTran

8 South West

7 Frontier

6 Virgin

5 Western Airlines

4 Norwegian Airlines

3 AirTran

2 Alaska Airlines

1 South West

Monday, September 1, 2008

Top 10 Funny Airline Commercials

Posted by

Taige Zhang

at

8:51 PM

0

comments

![]()

Wednesday, July 9, 2008

From Zoom to Gloom, which budget carrier will be next?

Summary:

With soaring fuel prices, a weak economy and poor sales, the Boyle brothers' airline didn't stand a chance. So which carrier will be next to have its wings clipped, asks William Lyons

BARELY a year ago John Boyle was in bullish mood at the launch of new fares for the airline that had promised to revolutionise transatlantic travel. He lambasted British Airways and Virgin for "fleecing passengers for too long" as he and his brother Hugh unveiled a route from London to New York for just £129 each way.

With two hot meals, designated seating and premium upgrades, it aimed to change long-haul air travel and make Scotland a powerhouse in global aviation. A stock market flotation was mooted, valuing the airline at up to £100m, while its summer flight schedule was spectacularly upgraded, offering 40% more seats across the Atlantic.

Not since the days of Sir Freddie Laker's Skytrain in the late 1970s had the established transatlantic carriers faced such a threat. Back then, despite huge support from the public and the Prime Minister, it took five years and an aggressive price dropping exercise for the competition to drive Laker out. But while British Airways, Pan Am, TWA and Lufthansa were said to have met to plot Laker's downfall, with Zoom they didn't have to: a soaring fuel bill did it for them.

As with other transatlantic carries such as MaxJet, Eos and Silverjet, Zoom's problems lay primarily with the price of oil, which last year added more than £27m to Zoom's fuel bill.

A combination of soaring oil prices, poor sales and a weak economy has precipitated the worst crisis to affect the global airline industry since the aftermath of the September 11 attacks. This year more than 27 airlines have gone bankrupt. By Thursday afternoon, with a last minute financial lifeline collapsing, the Boyle brothers had no option but to cancel all flights and begin bankruptcy proceedings, stranding passengers at several airports. The tally of failed airlines had just increased by one.

In a hastily worded statement the brothers said: "We deeply regret the fact that we have been forced to cease all Zoom operations. It is a tragic day for our passengers and more than 600 staff. We are desperately sorry for the inconvenience that this will cause passengers and those who have booked flights."

But as hundreds of passengers were left stranded, forced to pay thousands of pounds for alternative flights or to cancel their dream holiday, there was no crowing from the big airlines led by British Airways and Virgin Atlantic at the failure of this latest upstart attempting to seek to carve out a living in this lucrative but highly competitive route. Against a backdrop described as the "perfect storm", potentially more destructive "than our recent battles with all the Horsemen of the Apocalypse combined", many analysts are now speculating not if it will happen again but who will be next.

"It's going to be a difficult winter," says Wyn Ellis, aviation analyst at Numis Securities."The summer period tends to be quite good. If you can't make money in the summer you have a real problem but as we go into the winter demand naturally declines and it becomes much more difficult to make money."

It is a view echoed by aviation expert and author of The World's Major Airlines, David Wragg. "There will be several more collapses this year," he says. "While people concentrate on the big holiday airlines and national carriers the companies that are going to have real problems in the coming winter are the smaller airlines such as Eastern Airways and Loganair, who operate older, less fuel-efficient and smaller aircraft.

"Rising fuel prices have actually brought them to their knees. An airline such as Zoom does operate on fairly tight margins and the business is seasonal in contrast to cargo and business travel."

Zoom Airlines was formed seven years ago when Hugh Boyle, who had sold his tour business Direct Holidays to Airtours for £84m, moved to Canada and found a gap in the market for low cost, direct sale leisure travel.

He formed Go Travel Direct, the first such Canadian tour operator. But travel agents saw it as a threat and pressured airlines to boycott his clients. In response he and John launched their own airline, Zoom, based in Ottawa.

Initially its plan was to fly Canadians down to the US sunbelt and the Caribbean on winter package tours sold by Go Travel Direct. But the brothers still retained their links with UK tour operators, who were keen to seek out cheaper transatlantic flights. In 2004 Zoom launched a service between major Canadian and UK cities plus Paris. It was an unexpected success and led to them developing leisure routes between the UK and Canada. To some extent the airline copied the low-cost model with all bookings online or through call centres, keeping distribution costs low.

As the transatlantic traffic grew, a subsidiary company, Zoom Airlines Ltd, was established at Gatwick as a UK-regulated company to launch the UK-US routes. Zoom Airlines Inc remains registered in Ottawa as a Canadian carrier, regulated by the Canadian aviation authorities. International air traffic rights are closely tied to the nationality of airlines under the terms of bilateral air services treaties. As majority shareholder, Hugh Boyle was able to own both a UK and a Canadian airline by dint of holding dual UK and Canadian passports.

In 2006 the duo struck a £5.7m deal with Bank of Scotland Growth Equity to open up longer-haul routes from London to the US, Mexico and Bermuda. The move was heralded as giving them a head start on other airlines before the transatlantic open-skies agreement came into force. Momentum was with the airline. In August 2007, as revealed in Scotland on Sunday, brokers Collins Stewart and Panmure Gordon were asked by the management to explore the possibility of a flotation with a starting price of around £85m.

One City source said: "The timing was bad. No sooner had brokers been approached then the oil price started to move and the market began to get jittery. A flotation in this environment just wasn't a possibility."

With the oil price soaring to above $100 a barrel aviation conditions worsened, with airlines collapsing to the tune of two a month.

Last Wednesday afternoon, as one of Zoom's seven aircrafts landed at Calgary airport from London, it became clear the financial situation had reached crisis point. As the 180 passengers disembarked Aercap, the airlines leasing company, impound the Boeing 767 because of unpaid charges. A WestJet airline was summoned to take the remaining travellers on to Vancouver while Zoom executives quickly announced that they would be filing for creditor protection, allowing them to keep operating while the company went into administration.

It wasn't enough. News flooded through the industry. Creditors, suppliers and customers became more and more nervous. At Glasgow another jet was blocked as the Civil Aviation Authority demanded its fees. In Cardiff suppliers refused to refuel unless they were paid in cash.

By late Thursday afternoon the situation had become hopeless. As the administrators were contacted it became clear to Zoom's senior management that it could no longer afford to fly. At around 7pm Zoom collapsed, owing millions of pounds in fuel costs, leasing charges, airport fees and other supplies.

This morning, as Hugh Boyle begins another round of discussions with various parties interested in the airline, the situation looks bleak.

"We have to be realistic. The airline's planes are grounded with no immediate prospect of them flying again," he said. "But we will continue and do our best to examine every possible option.

"We are leaving no stone unturned. It is a bleak situation and I will be talking to people who have contacted us to at least discuss any possibilities regarding the business. Myself and the company will continue to liaise with other airlines to ensure that everything will be done for people to find alternative flights. This week administrators will be appointed in Canada and the UK and we will take things from there.

"I would just like to reassure passengers that everything possible was done on Thursday to keep our aircraft in the air but it proved ultimately impossible as the reaction to our position became even more intense.

"We certainly believed up until the last couple of hours that we could continue operations within the status of creditor protection, which the airline industry on both sides of the Atlantic has done on a regular basis. The domino effect of one aircraft impounded in Canada set in train a series of events that were absolutely unstoppable."

Meanwhile, the aviation industry continues to look over its shoulder to gauge who will be next. Late on Friday night it emerged that troubled Italian airline Alitalia had applied for bankruptcy protection as it tries to agree a deal to ensure its long-term survival.

"It is going to get a lot more complicated for passengers," says Wragg. "What we will see is the emergence of both lower and higher cost airlines. American Airlines have already started to charge people to put baggage in their hold while United is going to start charging economy class passengers for meals on a trial basis between London and Washington.

"The cost of air travel will have to rise and it will not just be start-ups and smaller carriers failing. We are going to see a few of the big, traditional airlines suffering."

The flight to failure

2001 Zoom is founded in Ottawa, Canada, by Scottish millionaires John and Hugh Boyle. Initially its plan is to fly Canadians down to the US sunbelt and the Caribbean on winter package tours sold by the brothers' travel business Go Travel Direct.

2004 Zoom launches its first transatlantic service with flights between major Canadian and British cities plus Paris. Zoom Airlines Ltd is formed in Gatwick for US-UK routes.

2006 The Boyle brothers strike a £5.7m deal with Bank of Scotland Growth Equity to open up longer-haul routes from London to the US, Mexico and Bermuda.

2007 As revealed in Scotland on Sunday, brokers Collins Stewart and Panmure Gordon are asked by the management of Zoom to explore the possibility of a flotation. The plan is for the starting price to be around £85m.

January 2008 At the beginning of January, oil breaks through the landmark $100 a barrel, driven by a slumping dollar, geopolitical instability and worries over a winter fuel supply crunch. The price of aviation fuel soars.

August 28, 2008 Zoom Airlines files for bankruptcy, grounds planes stung by sky-high fuel costs and cancels all flights, leaving hundreds of passengers stranded at airports.

The full article contains 1805 words and appears in Scotland On Sunday newspaper.

Page 1 of 1

* Last Updated: 30 August 2008 2:38 PM

* Source: Scotland On Sunday

* Location: Scotland

* Related Topics: Budget airlines

Posted by

Taige Zhang

at

12:44 AM

0

comments

![]()

Labels: airlines

Tuesday, May 27, 2008

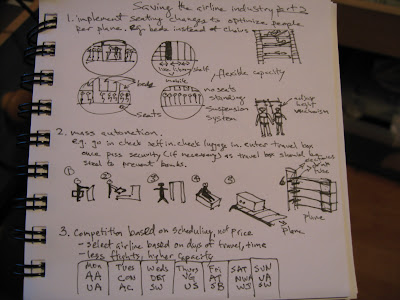

How to save the airline industry

Rising oil prices have led to a renewed interest in energy companies, automakers, and airlines. The US airline has recovered since its multi-billion losses in the early 2000s to gain profitability in 2006 and 2007. However, that recovery has been very short lived as analysts predict a loss for 2008 and possibility 2009.

These include SouthWest, JetBlue, and AirTran. However, most of the easy cost cutting methods already have been implemented (e.g. e-ticket, self check in, no meals) and further cost reductions would be difficult. The main focus shifts to additional revenue generation such as selling in-flight entertainment and taking advantage of increasing international demand to travel in the US.

Cost Cutting Ideas

Mergers and Alliances

Seasonal Airlines

Space optimization

Less Planes + More Direct Flights - Price Competition + Differentiation = More Efficiency

Instead of having redundant flights such as SFO to JFK from many different airlines being offered three times everyday, why not have a few more direct flights to undeserved routes such as SFO to YYZ by one airline at a time several times a month? There are still a lot of direct flights routes out there that are profitable if you promote it right and wait for a critical mass. Maybe it would be better to stop fighting over the same routes and differentiate on time, scheduleing, and routes. With the new 787 Dreamliner, an airline can advertise direct flights from X to Y for a price from time U to V and sell tickets months in advance. It essentially guarantees full capacity for every flight for its carefully researched and select direct flights. Enough with the "my airline is so great I'll serve you even if you live in Alaska", no let Alaska Air take care of them. I don't think people care anymore that an airline flies to more places than any other airline. They just go on Farecast and find the best deal.

Revenue Generating Ideas

Auction-style Pricing System

Instead of airlines competing to provide the lowest fares, have consumers bid for a seat on a plane like on eBay. Put the plane seating map online and let consumers bid for each seat. Of course there should be a "buy it now" button so customers can guarantee themselves a spot. But for the seats that haven't reached that price, availability depends on how much you're willing to pay, not how lucky you are.

Transnational Monorail™

Okay how about this? Forget planes all together. Imagine getting on the super high-speed electromagnetic carbon nanotube-based monorail that goes over everything, including the sea. You can even link it up to the International Airplane Hub. It'll use electricity so we can reduce our oil dependency. Okay I realize this is pretty crazy and impractical, but then again so are 23,600 planes flying non-stop 365 days a year and causing security concerns. (I assumed 10% annual growth in number of passenger airplanes in operation.)

I am sure engineers will find something that'll make travel less dependent on oil and more efficient. But for now we will have to rely on my TM™ blueprints.

Professional engineers will work on TM™ Prototype 3.

(I can see how Dyson quickly got up to 100 prototypes)

Posted by

Taige Zhang

at

11:25 PM

0

comments

![]()

Labels: airlines

Sunday, May 25, 2008

Airline Industry Bankruptcies & Profitability

Interesting list of airlines that went bankrupt (like Techcrunch's Deadpool). They say you can't make money with airlines unless you're short selling.

Posted by

Taige Zhang

at

3:54 PM

0

comments

![]()

Thursday, May 1, 2008

Airline Industry and AirTran Holdings Inc.(AAI)

So I thought I'd post some interesting findings about the Airline industry which should be consolidating finally. Although many people have been burned by it and Warren Buffett stays away from it, I think it has really been ravaged enough. I see limited down side and high upside here. There's so many reason why I invested in AAI which I won't go into now because it's exam time. The only thing that bothers me now about it is its PE is 31 compared to LCC's of 9. I am not sure I have found a good reason for this yet.

(from BusinessWeek)

(from BusinessWeek)Canadian airlines: Wild blue wonder

Megan HarmanFrom the April 28, 2008 issue of Canadian Business magazine

Talks of a global slowdown have markets on edge, yet one industry typically regarded as a foolproof economic barometer has seen nothing but blue skies. The domestic airline industry is flourishing. For 14 months in a row, WestJet has filled its planes to record levels, and last year Air Canada posted its strongest results in history. Demand is so strong that two new carriers are set to launch this year. All this good news even has analysts scratching their heads. “I’m as surprised as anyone about the resilience and the demand for air travel in Canada,” says Ben Cherniavsky, a Vancouver-based aviation analyst at investment firm Raymond James. It’s either a sign of a higher propensity to travel, he says, or simply an indication that the economy is not doing too badly after all.

The strong Canadian dollar is one factor, since many buy aircraft and fuel in U.S. dollars. “We’ve been able to weather increases in prices, especially on the fuel front, a lot better,” says Sam Barone, president and CEO of the Air Transport Association of Canada. Even though fewer Americans are flying internationally, Canadians have helped maintain a strong cross-border flow. Toronto-based Porter Airlines’ first U.S.-bound flights, to New York, received more bookings in the weeks prior to their late-March launch than all its other routes combined.

But the months to come might not be so rosy. With a potential recession hampering Canada’s largest trading partner, “there are a few clouds on the horizon,” says Barone. New carriers are edging onto the market with caution. Calgary-based Corporate Jet Air’s small-scale launch this spring will feature flights between Toronto and Calgary, testing the air before expanding to other cities. Its focus on speed and convenience for business travellers is not unlike that of Porter, but lavish amenities set Corporate Jet Air apart: planes that used to seat 50 have been transformed into roomy 18-seaters, and an all-inclusive fare features “gourmet” food and drinks, and limo service to and from the airport. “People are becoming more affluent and less patient, and more willing to pay for a premium service,” says Betty Ledgerwood, director of marketing and branding. “We just see that there’s a big niche in the market.”

AirTran Holdings, Inc., Statement On Completion of Recent Financing

ORLANDO, Fla., May 1 /PRNewswire-FirstCall/ -- AirTran Holdings, Inc. (NYSE: AAI), parent company of AirTran Airways, Inc., one of the nation's leading low-fare air carriers, today, in conjunction with the initial closing of the public offering of its debt and equity securities announced last week, issued a statement from Bob Fornaro, president and chief executive officer:

"The successful completion of these offerings, in combination with our low cost structure, high quality product and young all-Boeing fleet, provides improved financial flexibility and uniquely positions AirTran Airways for the challenges the industry faces in dealing with record high fuel costs. AirTran Airways is on solid footing during these turbulent times in the industry as evidenced by the following:

-- The initial closings of our concurrent offerings of our 5.50 percent Convertible Senior Notes due 2015 and our common stock have today been completed, including the full exercise of the underwriters' over-allotment option on our Convertible Senior Notes. Net proceeds to the Company of the concurrent offerings (including escrowed funds of approximately $12.3 million), were approximately $140.3 million. A closing with respect to the sale of an additional 2,346,875 shares of common stock pursuant to a partial exercise of the underwriters' over-allotment option is scheduled to occur on or about Friday, May 2, 2008.

S&P research on AAI (click to enlarge)

Posted by

Taige Zhang

at

8:01 PM

0

comments

![]()

Tuesday, January 8, 2008

Virgin America Airline (VX) Reschedule Policy

*They have a cool safety video. Strangely, they didn't show it the first time I flew. I think they forgot.

*Their in flight internet is still not working.

*In-flight entertainment is run on linux, redhat.

*Movies cost $8.

*They provide candy and a laptop sometimes at the waiting area.

Posted by

Taige Zhang

at

12:40 AM

0

comments

![]()

Thursday, December 27, 2007

Funny Airline Happenings in 2007

I read this on Yahoo. I thought it was pretty funny. Now I will keep a copy by forever quoting it on my site. I couldn't find who wrote it but the link is here.

Ten High-Flying Snafus

Tuesday, December 25, 2007

Southwest Airlines

Fly the not-so friendly skies

A Southwest Airlines gate agent tells Kyla Ebbert - a 23-year-old college student and Hooters waitress wearing a denim miniskirt, high-heeled sandals, and a sweater over a tank top - that she's dressed too provocatively to be allowed on a flight from San Diego to Tucson. Though the agent ultimately relents and lets her onboard, an indignant Ebbert goes public, appearing on the Today show. Southwest takes a massive publicity hit; Ebbert is hired by Richard Branson to promote rival low-cost carrier Virgin America and by Playboy to pose for a pictorial.

Singapore Airlines

Fly the don't-get-too-friendly skies

Singapore Airlines inaugurates the Airbus A380, the world's largest jet, with a seven-hour flight from Singapore to Sydney. To the chagrin of those who forked out $15,000 for one of 12 private, double-bed-equipped suites, the airline asks its passengers to refrain from having sex. Says first-class passenger Tony Elwood: "So they'll sell you a double bed, and give you privacy and endless champagne, and then say you can't do what comes naturally?"

Saudi Prince Alwaleed bin-Talal

Fly the I'll-join-the-mile-high-club- if-I-damn-well-please skies

Saudi Prince Alwaleed bin-Talal buys his own Airbus A380, paying more than $320 million for a "flying palace."

SkyWest Airlines

Fly the smells-like-the- back-row-of-a-Greyhound skies

SkyWest Airlines apologizes to passenger James Whipple after he is barred from using the plane's restroom during a one-hour flight from Boise to Salt Lake City.

Whipple, who says he had two "really big beers" before takeoff, winds up urinating into his airsickness bag and is questioned by airport police upon landing.

Doug Parker

Fly the well-at-least-he- didn't-have-to-use-an- air-sickness-bag skies

Just hours after US Airways comes up short in its $9.8 billion bid to acquire Delta, CEO Doug Parker is pulled over by police in Scottsdale, and arrested for drunken driving.

British Airways

Fly the petty skies

For its in-flight version of the James Bond flick "Casino Royale," British Airways edits out the cameo of rival Richard Branson and obscures the tail fin of one of Branson's Virgin Atlantic planes.

Southwest Airlines, Part 2

Fly the didn't-you-learn-anything- from-the-Kyla-Ebbert-fiasco skies

A man boarding a Southwest Airlines flight in Ohio is ordered to change his T-shirt, which depicts a fictional fishing shop with the words MASTER BAITER. The airline is again forced to apologize.

Iberia Airlines

Fly the someone-in- the-marketing-department- is-out-of-his-freakin'-mind skies Spanish national airline Iberia advertises its service to Cuba with a cartoon featuring dark-skinned Cuban women in bikinis bottle-feeding a tourist baby as he sings, "Feed me, mulattas ... come on, little mamas, take me to my crib." The women then transport the baby to the beach, dance for him, and massage him. After an outcry, the commercials are pulled.

Jet Blue

Fly the nope-we're-still-not-flying skies Despite whiteout conditions at New York's John F. Kennedy Airport during a Valentine's Day blizzard, Jet Blue loads passengers onto its planes, pulls the planes away from their gates ... and leaves them there, stranding hundreds of passengers on the runways for as long as 11 hours. "You can look out the window and you can see, there's the gate," says passenger John Farrell, who spent nine hours on the J.F.K. tarmac. "If you just let us off the plane, we can walk there."

British Airways Part 2

Fly the oh-gross-oh-gross-oh gross-get-it-away-from-me skies On a British Airways flight from New Delhi to London, first-class passenger Paul Trinder wakes up from a nap to find the corpse of a woman who had died in the economy cabin being placed in the seat next to him. Upon complaining about the incident, Trinder - a gold-level frequent flier who logs 200,000 miles a year with the airline - says he is told he will not be compensated and should just "get over it."

Posted by

Taige Zhang

at

6:27 PM

0

comments

![]()

Labels: airlines