Rising oil prices have led to a renewed interest in energy companies, automakers, and airlines. The US airline has recovered since its multi-billion losses in the early 2000s to gain profitability in 2006 and 2007. However, that recovery has been very short lived as analysts predict a loss for 2008 and possibility 2009.

This past week (May 20-24, 2008) US Airways (LCC) lost 46%, United (UAUA) 45%, American (AMR) 31%, Northwest (NWA) 29%, Delta (DAL) 27%, Continental (CAL) 27%, Alaska (ALK) 17%, Jetblue (JBLU) 14%, Airtran (AAI) 11%, Allegiant (ALGT) 13%, and Frontier (FRNTQ) and Southwest (LUV) 8%. It's shocking how much shares have fell simply because of rising oil prices. Other news such as cost cutting measures have been positive.

My ranking of relative strength in the current environment would be Southwest (read about their strategy for success), JetBlue, and then Alaska. But in good conditions US Airways, Alaska, and then Airtran. The graph shows stock prices of several airlines over a span of 3 months and the table shows the operating statistics of most US airlines.

After reading S&P's May 15, 2008 Report on Airline Industry by Jim Corridore, I did some thinking on how to save the business. But first let's review some key findings and statistics.

Passenger load factor is increasing so demand is not as elastic as the fare wars make it out to be. People that need to travel will travel despite higher prices, to a large extent. In addition the US currency depreciation means more people will visit and travel to and in the US (foreign travelers will supplement demand). Holiday travel is largely recession proof.

These include SouthWest, JetBlue, and AirTran. However, most of the easy cost cutting methods already have been implemented (e.g. e-ticket, self check in, no meals) and further cost reductions would be difficult. The main focus shifts to additional revenue generation such as selling in-flight entertainment and taking advantage of increasing international demand to travel in the US.

What most airlines are doing is waiting for oil prices to drop because hedge contracts won't last forever. Hoping to ride out the storm, they are cutting routes, slashing expansion plans, retiring fuel inefficient planes, eliminating in-flight snacks and frills, charging for once free services such as luggage, and increasing fare prices. Some are trying to find new revenue streams such as advertising. Yes bring back the Pokemon plane.

Obviously, the airline industry is in trouble and there's a huge problem when the whole industry drops 21% in 5 days. Many experts say the business model needs to be changed now that high oil prices are here to stay. And I agree. It's not really my problem because I am not an airline executive, but I like solving problems. If I could get a job solving random problems, I'd be happy. I am not a consultant or an airline industry expert, but from my hours of research and business knowledge, I think I can provide some answers:

Cost Cutting Ideas

Mergers and Alliances

2007 was an awful year for flying because of delays, cancellations, bad weather, lost luggage, overcapacity. I remember they had to divert some flights to military bases around Thanksgiving. 2001 saw the blocking of US Airways and United Airlines merger, which caused both to file for bankruptcy. 2005 marks the start of M&A season with the marriage of US Airways and America West (I still remember the stopping in Phoenix crap). 2008 hints at more mergers to come. Mergers seem like a good idea because of flying overcapacity and financially weak airlines. Customers may also benefit with less delays, smoother and more pleasant trips, less confusion and time wasted scouring the web for cheap deals from the 20 major, 32 national, and 89 regional airlines (though there are more tools out there to help you) and more rewards; however, prices will increase (good for airlines) and fewer flights (which is good for the environment). It's similar to a quality over quantity tradeoff. Implementation of the mergers will be difficult because of the complexity with unions, structuring, contracts, fleets, and flight logistics. In addition, regulators are still making it somewhat difficult and there are risks that mergers make not provide the intended results.

However, I believe airlines were privatized because at the time it was too difficult to provide high quality service at low prices. But Airlines seem to gravitate to consolation because of their cyclical and interdependent business. Airlines have constantly been struggling to stay alive. See bankruptcy list and profitability post.

I am confident that consumers can be well off with three major airlines. Take the UK or Canada as examples. In addition, now we have the ability to manage flights more efficiently. As airline alliances such as Star Alliance have shown they can work together to realize cost savings through sharing cargo and passenger terminal facilities; integrating frequent-flyer programs, consolidating sales, maintenance, and administrative operations; combining information technologies; coordinating advertising; and participating in joint procurement. It mitigates the concern of not being able to achieve synergies.

Regulations

I think regulating the number of flights can reduce costs for airlines because with fewer flights, passenger capacity increases and delays are reduced. Charging airlines more for peak time flights could reduce congestion and delays. Prohibiting various forms of advertising could reduce fare wars and reduce advertising costs. Forbidding predatory pricing can also save airlines.

International Airplane Hub

This is a risky and probably unrealistic move, but still should be considered. Governments and airlines could work together to build an International Airplane Hub that is away from major cities at an optimal route location, maybe even in the middle of the Atlantic or Pacific ocean where planes could land. This can provide planes with refueling stations so they don't need to fly at full fuel capacity. This allows for more efficient use of different types of jets. It can yield more efficient routes and higher passenger capacity like a hub but at lower real estate, security, and tax costs. Airplanes can experience more efficient take offs through the use of downward inclined runways, conveyer belt runways, and other new technologies.

Reduce domestic flights and build better rail services

Create faster trains and more rail routes for passengers to travel on land rather than by air for domestic travel. This is something the government must do or let some private equity houses engage in. Ask Japan for the blue prints while their economy is still weak. Chinese labor is not free this time, but still pretty cheap.

Seasonal Airlines

Airlines get most of their profits during the summer, just like retailers get most of their profits during Christmas. Despite the high fixed costs, I am sure some airlines can make it work. Maybe drop routes during off-peak and add routes during peak season? Charter planes out likes buses during off season? How fast do planes depreciate if you just let them sit during off season? With high levels of automation and service for hire/contractors, idling employee should be less of a concern. I wonder if you can contract pilots for specific time periods?

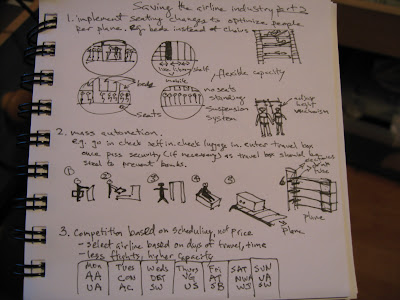

Massive Automation and Layoffs

To be honest, I like dealing with people but we need to save the airline industry. Almost everyone who I interact with before and during a flight can be cut out. The check-in person can be eliminated. I think I can weigh my own bag and put on a sticker. The person who announces business class and people traveling with children may now board can also be promoted to some other position or let go. The flight attendants too. Just put a water cooler somewhere. It'll be self serve. The co-pilot can step in if something really goes wrong. I am guessing everyone knows how to put on a seatbelt by now and have smart phones that tell the local time. iRobots can do the rest. We'll have in-flight customer service phones answered by people in India. I remember one plane I was on, I said good bye to like 7 flight attendants on my way out.

Space optimization

Space optimization

This may not be easy because many airlines lease planes and don't make planes. But the ideas is to implement seating changes to optimize people per plane. (I think the 787 dreamliner was designed with this in mind). This may involve using beds, limiting carry on items, introducing standing areas, mobile seats/beds. There is still a lot of underutilized space on airplanes. Have you considered "standby" as in standing for the whole 2-4 hour flight? Of course you can introduce the standing suspension system which reduces leg fatigue. See diagram. Haha.

Less Planes + More Direct Flights - Price Competition + Differentiation = More Efficiency

Instead of having redundant flights such as SFO to JFK from many different airlines being offered three times everyday, why not have a few more direct flights to undeserved routes such as SFO to YYZ by one airline at a time several times a month? There are still a lot of direct flights routes out there that are profitable if you promote it right and wait for a critical mass. Maybe it would be better to stop fighting over the same routes and differentiate on time, scheduleing, and routes. With the new 787 Dreamliner, an airline can advertise direct flights from X to Y for a price from time U to V and sell tickets months in advance. It essentially guarantees full capacity for every flight for its carefully researched and select direct flights. Enough with the "my airline is so great I'll serve you even if you live in Alaska", no let Alaska Air take care of them. I don't think people care anymore that an airline flies to more places than any other airline. They just go on Farecast and find the best deal.

Revenue Generating Ideas

Less Planes + More Direct Flights - Price Competition + Differentiation = More Efficiency

Instead of having redundant flights such as SFO to JFK from many different airlines being offered three times everyday, why not have a few more direct flights to undeserved routes such as SFO to YYZ by one airline at a time several times a month? There are still a lot of direct flights routes out there that are profitable if you promote it right and wait for a critical mass. Maybe it would be better to stop fighting over the same routes and differentiate on time, scheduleing, and routes. With the new 787 Dreamliner, an airline can advertise direct flights from X to Y for a price from time U to V and sell tickets months in advance. It essentially guarantees full capacity for every flight for its carefully researched and select direct flights. Enough with the "my airline is so great I'll serve you even if you live in Alaska", no let Alaska Air take care of them. I don't think people care anymore that an airline flies to more places than any other airline. They just go on Farecast and find the best deal.

Revenue Generating Ideas

Increase Prices (especially in the summer)

People are very sensitive to price especially since they are comparing them side by on using websites like Farecast. A dollar difference can persuade disloyal customers like me and 90% of travelers. I think we can learn from Megabus which was extremely successful in the UK and has now expanded to America and Canada. Can their business and pricing model be transferred? They just came in and beat Greyhound like it was a bag of corn. If not, increase prices so you are at least breaking even because people need to travel. They are price sensitive given the prices airlines set (as in the prices listed) but would not forgo air travel altogether considering the substitutes such as rail, car, and bus usually don't quite match up. Just remember if an airline prices very low, it is losing money or not making much. Cost-cutters only have a limited number of seats they can fill.

Fuel-Based Pricing System

Airfares that fluctuate with oil prices. Let consumers deal with oil prices and travel accordingly. This spreads the burden over a larger audience.

Contract with businesses/frequent travelers

Instead of selling "pay as you go" (what we are doing now) sell a "monthly plan" to corporations and frequent travelers. Revenues and demand will be more predictable and smoother. Fuel costs can be incorporated faster and less obviously by changing points required for a particular flight. For example, an executive working for RIM is on the 500 points per month plan which he pays for at discounted price of $1,300 a month. Unused points are rolled over. He uses 230 points for a flight from YYZ to LHR, 260 on a flight from LHR to SFO (using another airline in the same alliance which costs 10% more points), 3 points on in-flight entertainment and food, 7 points from Start Alliance online store, and realizes he needs to make trip to HKG. If he still had points, it would have cost 225 points but because he is out of points he must purchase 225 points at a 25% premium to take the trip. A non-contract traveler would have to buy points at a 50% premium. Personally, I think this is a lot less complicated than our current frequent flier miles system. Also if you sign a 18 month contract, you get a free jet.

Auction-style Pricing System

Instead of airlines competing to provide the lowest fares, have consumers bid for a seat on a plane like on eBay. Put the plane seating map online and let consumers bid for each seat. Of course there should be a "buy it now" button so customers can guarantee themselves a spot. But for the seats that haven't reached that price, availability depends on how much you're willing to pay, not how lucky you are.

Auction-style Pricing System

Instead of airlines competing to provide the lowest fares, have consumers bid for a seat on a plane like on eBay. Put the plane seating map online and let consumers bid for each seat. Of course there should be a "buy it now" button so customers can guarantee themselves a spot. But for the seats that haven't reached that price, availability depends on how much you're willing to pay, not how lucky you are.

International Airplane Hub (cont'd)

This can also provide additional revenue to airlines which share the profit generated by spending on the Hub. If the Hub is on an island that permits gambling, this could be pretty big.

Transnational Monorail™

Okay how about this? Forget planes all together. Imagine getting on the super high-speed electromagnetic carbon nanotube-based monorail that goes over everything, including the sea. You can even link it up to the International Airplane Hub. It'll use electricity so we can reduce our oil dependency. Okay I realize this is pretty crazy and impractical, but then again so are 23,600 planes flying non-stop 365 days a year and causing security concerns. (I assumed 10% annual growth in number of passenger airplanes in operation.)

I am sure engineers will find something that'll make travel less dependent on oil and more efficient. But for now we will have to rely on my TM™ blueprints.

Professional engineers will work on TM™ Prototype 3.

(I can see how Dyson quickly got up to 100 prototypes)

Transnational Monorail™

Okay how about this? Forget planes all together. Imagine getting on the super high-speed electromagnetic carbon nanotube-based monorail that goes over everything, including the sea. You can even link it up to the International Airplane Hub. It'll use electricity so we can reduce our oil dependency. Okay I realize this is pretty crazy and impractical, but then again so are 23,600 planes flying non-stop 365 days a year and causing security concerns. (I assumed 10% annual growth in number of passenger airplanes in operation.)

I am sure engineers will find something that'll make travel less dependent on oil and more efficient. But for now we will have to rely on my TM™ blueprints.

TM™ Draft I.

Professional engineers will work on TM™ Prototype 3.

(I can see how Dyson quickly got up to 100 prototypes)

And that's how I solved the "how to save the airline industry" problem in one afternoon.

No comments:

Post a Comment